News: Real Estate Investors in Ontario & Real Estate Tech Funding

- Shael Soberano

- Dec 1, 2021

- 2 min read

Updated: Jan 11, 2022

In this week's Industry News (Week of 29 Nov 2021).

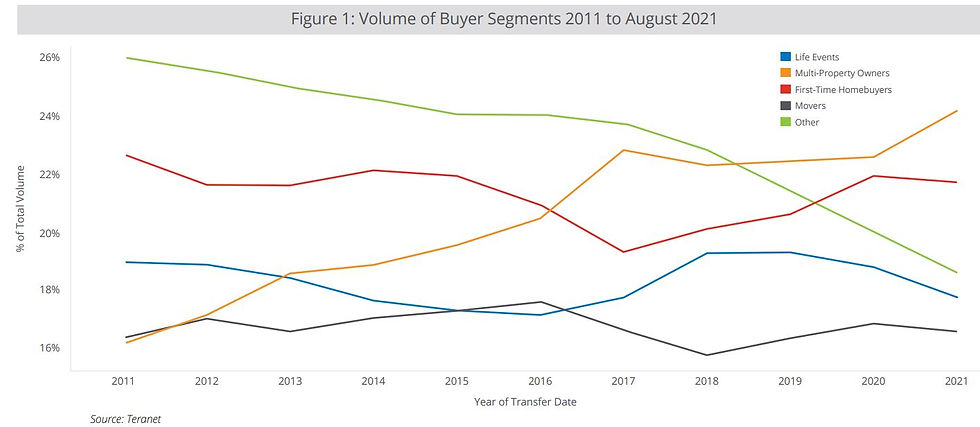

Investors now make up more than 25% of Ontario homebuyers| CBC Investors, the smallest segment of buyers 10 years ago, now appear to be the largest. And as prices skyrocket, recent data suggests people who own more than one property in Ontario make up more than 25% of buyers in the province. It's a stark contrast to just 10 years ago when investors made up the smallest percentage of residential real estate transactions. According to the data, they now make up the largest segment. Recent data published by Teranet in its quarterly Market Insight Report shows that multi-property owners made up more than 25 per cent of real estate transactions between January and August of 2021.

This graph taken from Teranet's quarterly Market Insight Report breaks down buyers by segment. Multi-property buyers are orange, while first-time buyers are red. Life events (in blue) are instances where there is a transfer of ownership between people who are related, due to things like death, marriage or divorce. Over the past decade, multi-property owners have gone from the smallest segment to the largest. (Teranet)

See full article here and full report here.

Real-Estate Tech Fundraising Soars To Record in 2021 | The Wall Street Journal Growing landlord demand for better data, new apps and other real-estate technology is fueling a boom in proptech and attracting record sums of capital into the sector during the pandemic. Venture capitalists and other investors poured $9.5 billion into proptech through mid-November, according to data firm CB Insights. That is the most ever raised in any year, topping the $9 billion invested in the sector for all of 2019, the previous record. Proptech has been making strides on the residential side, too. Place, a company that provides technology and business services for home sales agents, said on Wednesday that it closed a $100 million funding round led by Goldman Sachs Asset Management, valuing the firm at $1 billion. The flood of capital into proptech this year contrasts with a slump in the business last year when the country was hit by the full brunt of the pandemic. Capital raising slumped to $8.1 billion, down about 11% from 2019, according to CB Insights. See full article here.

Konfidis is pleased to share our weekly real estate investing industry news piece herein. We love connecting with our members. Reach out with your questions to hello@konfidis.com.

Shael Soberano, CFA Konfidis Inc. Chief Investment Officer

Ready to start the process of buying a real estate investment property?

Try out Konfidis, we've built a product that does the search for you. We've developed a simple way to invest using big data, cutting-edge technology, plus our team of experts to help you outperform the market.

Talk to us today to receive our recommended investment properties.

Comments